“The analytical company Canalys has updated the statistics on TWS headphone shipments for the first quarter of 2025. In addition to the dry figures on shipment volumes, experts have also compiled a more visual list of the most popular brands of wearable acoustics”

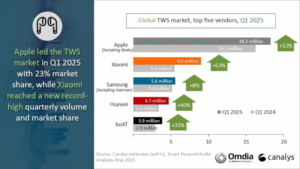

According to the analytical company Canalys, the most popular brands of TWS (True Wireless Stereo) headphones based on shipment volumes in the first quarter of 2025 were:

- Apple (including Beats): Shipped 18.2 million units, showing a 12% year-over-year growth. This indicates Apple’s continued strong hold on the premium segment and the combined strength of its main brand and the Beats sub-brand.

- Xiaomi: Achieved the second position with 9 million units shipped, experiencing a significant growth of 63% compared to the same period last year. This highlights Xiaomi’s increasing popularity and success in capturing a larger share of the TWS market, likely driven by its focus on offering feature-rich yet affordable options.

- Samsung (including Harman): Ranked third with 5.6 million units shipped, demonstrating an 8% growth. Samsung’s performance, combined with its audio subsidiary Harman (which includes brands like JBL and AKG), solidifies its position as a key player in the TWS market, catering to various price points and user needs.

- HUAWEI: Secured the fourth spot with 4.7 million units shipped, marking a substantial 40% increase year-over-year. Despite facing certain market challenges in some regions, HUAWEI continues to show strong growth in the TWS segment, particularly in its domestic market.

- boAT: An Indian brand, rounded out the top five with 3.9 million units shipped, achieving a 31% growth. boAT’s strong performance indicates the increasing prominence of local brands in specific markets, offering competitive products at attractive prices.

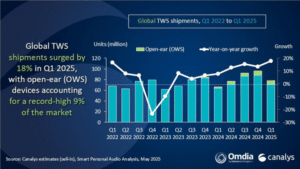

Overall Market Growth:

The report also highlighted that the total volume of TWS headphone shipments in the first quarter of 2025 saw an impressive 18% increase compared to the same period in the previous year. This marks the highest growth rate for this period since 2021, signifying a continued strong demand for true wireless audio solutions.

Growth Drivers:

Experts at Canalys attributed this growth to several factors:

- Expansion of Sales Geography: Brands are increasingly expanding their reach into new markets, contributing to higher shipment volumes.

- Diversification of Price Segments: Offering a wider range of products across different price points allows brands to cater to a broader consumer base.

- Increased Deliveries to the US: Concerns about potential future customs tariffs reportedly led to a rise in shipments to the United States during this period.

This data provides valuable insights into the current landscape of the TWS headphone market, showcasing the leading brands and the factors driving its continued expansion.